We remain positive on the equity market. We believe we are in a secular bull market that should last until nearly the end of this decade.

We believe Artificial Intelligence (AI), Blockchain, robotics, and Web 3.0 (crypto) will be the primary drivers of the U.S. economy and markets for the rest of the decade. Similar to how the widespread adoption of personal computers in the 1980s and early 1990s paved the way for the internet to revolutionize the global economy, markets, and social structures, we believe these emerging technologies will transform whole industries and redefine the way the world operates. This process has only just begun as we reach the middle year of this decade.

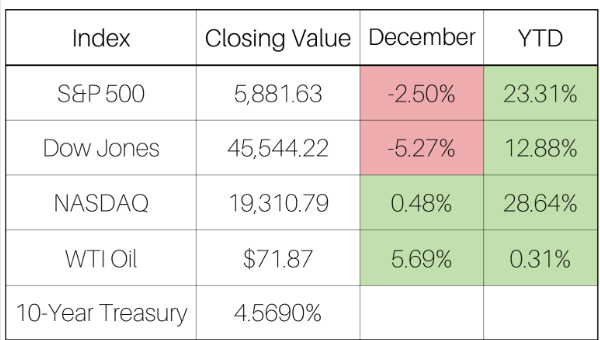

Our target for the S&P 500 in 2025 remains 7200–7400, and before the decade ends, we expect to see the S&P 500 reach 10,000–13,000. If we are correct, leaps in productivity should make for increases in Returns to Capital. Today the U.S. is already significantly above other countries in its level of productivity as the accompanying chart illustrates.

The risk to our outlook is if inflation begins to rise sustainably, causing the Federal Reserve (Fed) to switch course and raise interest rates.